Get Certified with NACM Southwest

NACM Southwest is your go-to resource for comprehensive business credit education and networking. Today’s credit professionals face increasingly complex challenges—rapid credit decisions, multi-phase collections, evolving technologies, government regulations, and globalization. To successfully navigate this complexity, credit professionals must continuously expand their knowledge and build strong professional networks.

Earn Your Certification with NACM Southwest

- Credit Business Associate (CBA)

- Credit Business Fellow (CBF)

- Certified Credit and Risk Analyst (CCRA)

- Certified Credit Executive (CCE)

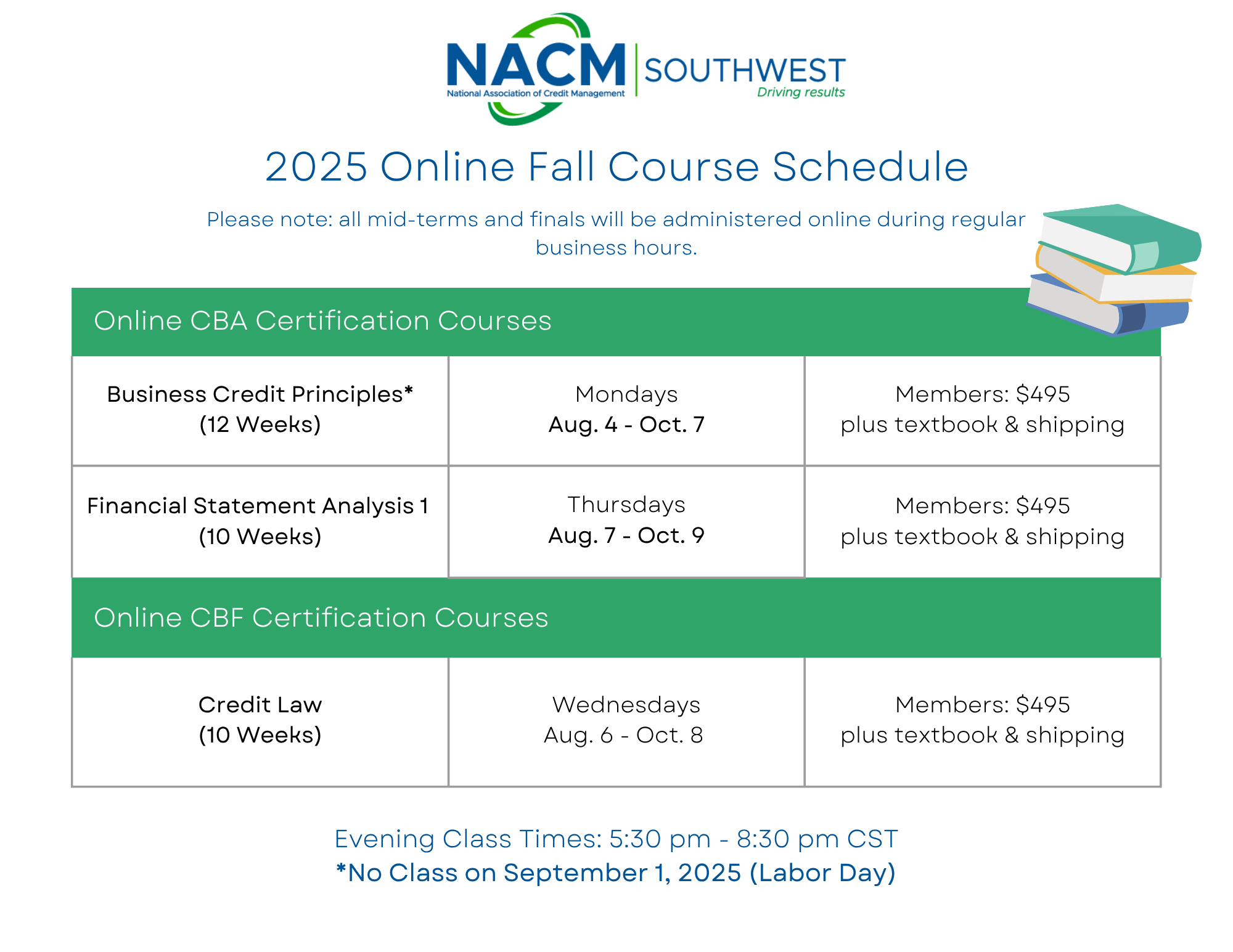

Online Fall 2025 Certification Courses

*In-person class registration will be open soon!

In-Person Summer/Fall 2025 Certification Courses

Credit Business Associate (CBA) Requirements

The Credit Business Association (CBA) is an academic designation that demonstrates proficiency in three key business credit areas: Business Credit Principles, Basic Financial Accounting, and Financial Statement Analysis I. This designation does not require a minimum level of work experience or Career Roadmap points.

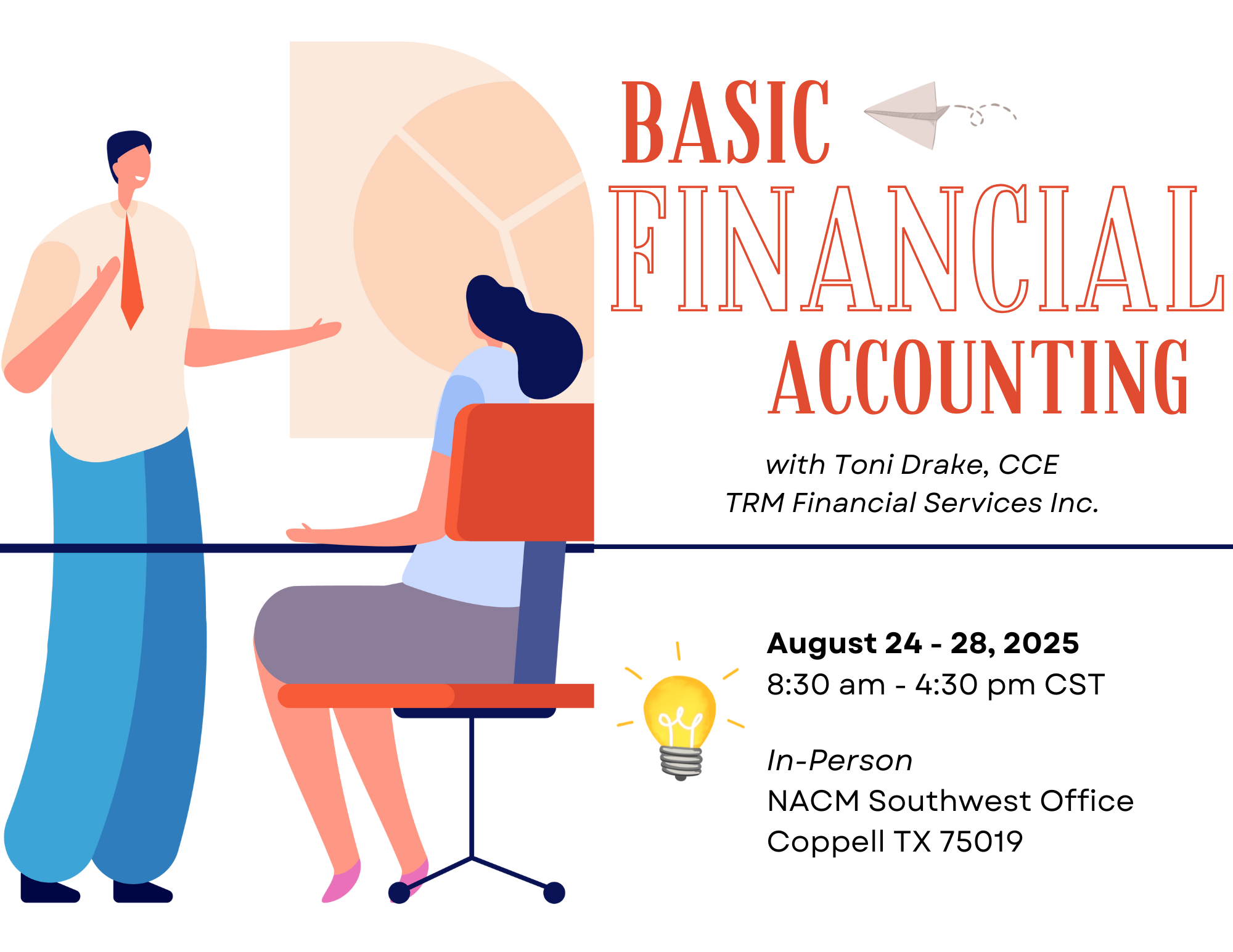

Basic Financial Accounting

NACM Southwest Office

August 24 – 28, 2025

Certified Credit and Risk Analysis (CCRA) Requirements

The Certified Credit and Risk Analyst (CCRA) is an academic designation that demonstrates expertise in analyzing and interpreting financial statements, along with the ability to make well-informed credit risk assessments. Required coursework includes Basic Financial Accounting, and Financial Statement Analysis I. This designation does not require a minimum level work experience or Career Roadmap points.

Financial Statement Analysis Pt. 1

NACM Southwest Office

October 5 – 9, 2025

Credit Business Fellow (CBF) Requirements

The Credit Business Fellow (CBF) is both an academic and participation-based designation that demonstrates expertise in business credit. To earn this designation, individuals must first obtain the CBA designation and complete the Business Law and Credit Law courses. Applicants must accumulate Career Roadmap points to qualify.

Certified Credit Executive (CCE) Requirements

The Certified Credit Executive (CCE) is NACM’s most prestigious designation, recognizing individuals capable of managing the credit function at an executive level. Candidates must meet specific professional and educational standards, accumulate Career Roadmap points, and demonstrate proficiency in accounting, finance, domestic and international credit concepts, management, and law. CCE’s are required to recertify every three years, reflecting their dedication to continuing education, self-improvement, and advancing the business credit profession.

Exam Dates & Application Deadlines for CBA, CBF, and CCE Designation Programs

| Application Deadline | Nationwide Test Date |

| Friday, September 13, 2024 | Monday, November 4, 2024 |

| Friday, January 10, 2025 | Monday, March 3, 2025 |

| Friday, April 4, 2025 | Sunday, May 18, 2025 (Credit Congress, Cleveland, OH) |

| Friday, May 30, 2025 | Monday, July 21, 2025 |

| Friday, September 12, 2025 | Monday, November 3, 2025 |

CICP & ICCE Certifications

For more information on Certified International Credit Professional (CICP) and International Certified Credit Executive (ICCE) visit NACM National.

I can’t tell you enough how the certification program has benefited me through all stages of my career, but I know it is monumentally important as it has and continues to guide me in my day-to-day decisions.

Worth the work and time it takes to get your professional designations! I have them all! It truly has contributed to advancing my career. The networking is no small thing, either. I’ve made some great friends and many professional acquaintances along the way.