Credit Managers' Index

Credit Managers’ Index

A Powerful Tool

Since its inception, the CMI has been a startlingly accurate economic predictor, proving its worth most notably during the recession.

The CMI is created from a monthly survey of U.S. credit and collections professionals. The survey asks participants to rate whether factors in their monthly business cycle – such as sales, new credit applications, accounts placed for collections, dollar amount beyond terms – are higher than, lower than, or the same as the previous month. The results reflect the entire cycle of commercial business transactions, providing an accurate, predictive benchmarking tool.

CMI reports are released to the media on the last business day of each month. If your business extends to other commercial businesses and you are located in the 50 US states and US territories, we encourage you to participate in the survey. NACM membership is not required.

More Information

In the case of the Purchasing Managers’ Index (PMI), it depicted an economy flirting with recession in the run-up to the downturn, but seemed to have trouble committing. The overall PMI reading tiptoed around 50, recording 50.4, 49.9, & 50.7 in September, October, and November of 2007, respectively. It then dipped to 48.7 in December 2007, before hopping back up to 50.5 in January 2008, and eventually crashed to the 30s late in that year and in early 2009. During this period, the CMI mirrored the PMI on occasion, but altogether showed a remarkable sensitivity to the intricacies of the recession, resisting the month-to-month swings that seemed to characterize the PMI. For credit professionals looking for the expected economic trend of the next few months, they needed to look no further than the CMI.

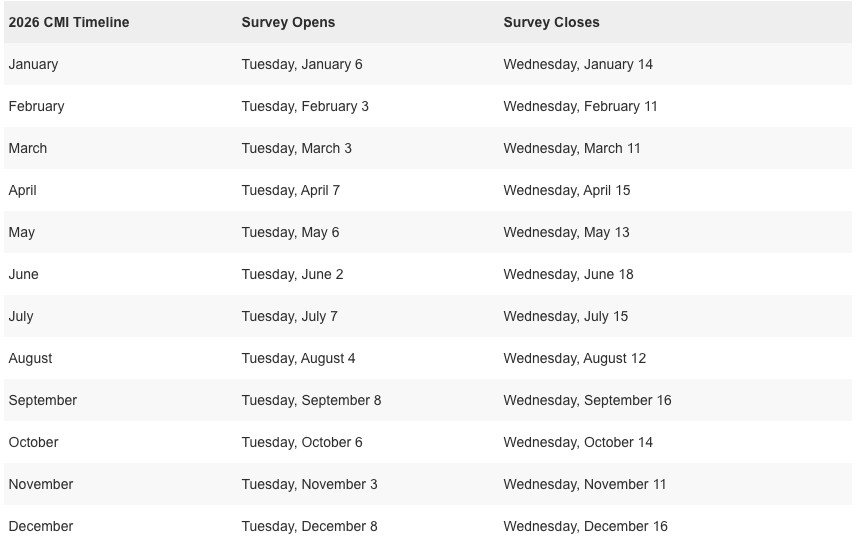

2025 Survey Dates

CMI Testimonials

I began participating in the Credit Managers’ Index to earn credits toward my Certified Credit Executive designation. What started as a simple task—reviewing reports and submitting data—quickly proved to be incredibly valuable. With a background in Finance and Accounting, I soon realized that strong credit decisions rely on access to timely, relevant data. The CMI offers a monthly snapshot of the economy, which has been especially important during these recent volatile years. As Credit Managers, we must use every resource available to make informed decisions, and the CMI is an easy yet invaluable tool in that effort.

I learned about the CMI during a random conversation in one of our monthly meetings about a year ago and have been participating ever since. I love seeing that the things spurring questions for me are appearing as a similar trend in the industry. Each month, I’m able to see where I need to adjust to align with other credit managers as well as when I have the room to take bigger risks or need to pull back. The questions are simple and take less than 5 minutes to complete, but the data gained helps to set me up for the next 30 days. We’re all in this together, so having more participation would only increase the CMI as a tool.